does new hampshire charge sales tax on cars

Charge a vehicle to an electric source within public areas eg parks. There is also a 7 tax on phone services and a 75 per 100 tax on real estate.

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

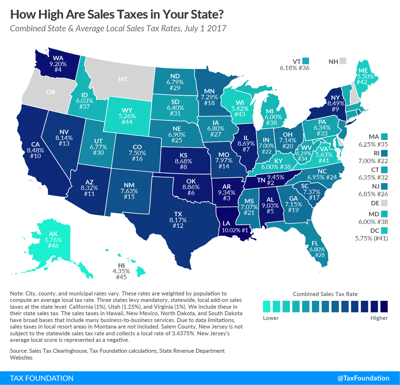

. Only five states do not have statewide sales taxes. These types of discounts reduce the purchase price of the vehicle. And remember that sales tax rates vary depending on your businesss location.

New Hampshire Delaware Montana Oregon and Alaska. There are however several specific taxes levied on particular services or products. These five states do not charge sales tax on cars that are registered there.

How Can I Avoid Paying Sales Tax On A Car. Four estimate payments are required paid at 25 each on the 15th day of the 4th 6th 9th and 12th month of the taxable period. Montana additionally imposes some special taxes in resort areas.

How do I get a sales and use tax exemption certificate. New Hampshire does collect. There are however several specific taxes levied on particular services or products.

However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to. New Hampshire is one of the few states with no statewide sales tax. For example a 28000 car that has a 1500 cash rebate reduces the vehicles sales price to 26500.

No there is no general sales tax on goods purchased in New Hampshire. New Hampshire is one of the few states with no statewide sales tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

The Granite States low tax burden is a result of. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. Does New Hampshire have a sales tax.

Some other states offer the opportunity to buy a vehicle without paying sales tax. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register the vehicle with your home states DMV. An automobile park or petrol station that is paid at the standard rate of 20 for parking for example in a parking space.

There are currently nine states without income tax. Keep in mind that Alaska Delaware Montana New Hampshire and Oregon do not have sales tax and therefore do not have any sales tax laws. 3120 and up based on type and weight plus 10 transfer fee plus local fees.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. - Answered by a verified Tax Professional. 8 15 new registration.

Exact tax amount may vary for different items. Does New Hampshire chage a sales tax when buying a used car. Map and driving directions.

In addition to taxes car purchases in Maine may be subject to other fees like registration title and plate fees. A sales tax of 9 exists on prepared meals in restaurants short-term room rentals and car rentals. So if you live in Massachusetts a state that has sales tax but buy a car in New Hampshire a state with no sales tax you will still have to pay tax to your home state of Massachusetts when you go to get your license plates.

50 rows Are there states with little to no sales tax on new cars. With no car sales tax in the state you buy you will most likely buy in the state where you live. New Hampshire.

States With No Sales Tax on Cars. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a. For vehicles that are being rented or leased see see taxation of leases and rentals.

Washington DC the nations capital does not charge sales tax on cars either. If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. States like Montana New.

Most states charge sales tax on the full purchase price of the vehicle BEFORE the rebate is applied to discount the vehicle. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

That means youll be taxed only on 20000 instead of. No capital gains tax. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level.

Alabama Alabama has both state and local sales tax. No inheritance or estate taxes. Similar to income taxes payroll.

The Department has no authority to issue a certificate. Only Oregon Montana New Hampshire Alaska and Delaware dont tax sales as of 2021 but Alaska allows local counties and municipalities to levy sales taxes of their own. New Hampshire is one of the five states in the USA that have no state sales tax.

Montana Alaska Delaware Oregon and New Hampshire. We use cookies to give you the best possible experience on our website. Most states charge sales tax on vehicles.

2022 New Hampshire state sales tax. Below we list the state tax rate although your city or county government may add its own sales tax as well. Yes for taxable periods ending on or after December 31 2013 if your estimated tax liability exceeds 260.

Maine collects a 55 state sales tax rate on the purchase of all vehicles. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Depending on your location these laws can vary.

Supplemental Govermental Services Tax based on vehicle value. Property taxes that vary by town. Traveling out of state to buy a used vehicle will not save you from paying state sales tax.

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New 2016 Lance 1050s Truck Camper Truck Camper Camper Trucks

Freedomland S City Tax Certificate

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Should You Be Charging Sales Tax On Your Online Store Income Tax Best Places To Live Filing Taxes

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How Do State And Local Sales Taxes Work Tax Policy Center

Car Tax By State Usa Manual Car Sales Tax Calculator

How Much Does Your State Collect In Sales Taxes Per Capita

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

How Is Tax Liability Calculated Common Tax Questions Answered

New Jersey Sales Tax Small Business Guide Truic