unrealized capital gains tax california

Texas long term capital gain rate 0. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains.

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

All capital gains are taxed as ordinary income.

. Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired. Thus capital gains and losses are reported in the year in which the investment fund buys or sells the underlying stocks or bonds or funds.

532 Glossary of Terms. Such a tax is really a tax on wealth. If you have a difference in the treatment of federal and state capital gains file.

This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase. Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out capital gains if a mutual fund is sold etc. If that phrase.

National Investment Income Tax 38. 531 Examining the Built-In Gains Tax Issue. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains.

Taxing unrealized Capital gains on the value of securities is rich. In California HSA accounts are treated as a normal investment account. In general an S corporation is subject to the built-in gains tax when it converted from a C corporation and the S corporation recognizes an.

Actually good point. If that phrase. California long term capital gain rate 133.

30 2021 Published 1040 am. Increasing top tax rates for individuals. Federal long term capital gain rate 396 BidenYellen proposal v 20 today.

The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on unrealized capital gains from any taxable asset including but not limited to covered and noncovered tradable assets gifts bequests and transfers in trust except to the extent that. If an asset is projected to make money but you dont cash in on that profit its an unrealized gain. Unrealized Capital Gains Tax CaliforniaCalifornia does not have a lower rate for capital gains.

Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040. California does not have a lower rate for capital gains. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase.

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. To report your capital gains and losses use US.

Unrealized Capital Gains Tax California. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains.

531 Examining the Built-In Gains Tax Issue. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the federal reserve. How to report Federal return.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. National Investment Income Tax 38. Total long term capital gain rate 567.

Unrealized Capital Gains Tax. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress. This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on unrealized gains.

Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm August 20 2020 723 pm. Anyone else care to chime in. California long term capital gain rate 133.

What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. California does not have a lower rate for capital gains. In reality it is a tax on wealth.

This new tax is similar to the wealth taxes pushed by radical. A Texas resident would see the following taxes. It would impose significant tax liability when first implemented as taxpayers would be required to pay taxes on.

Long Term Capital Gains Tax California How To Discuss

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Taxing Unrealized Capital Gains A Bad Idea National Review

The Unintended Consequences Of Taxing Unrealized Capital Gains

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets

Understanding The California Capital Gains Tax

Tax Strategies Using Nua For Modestly Appreciated Stock

Net Unrealized Appreciation Bogart Wealth

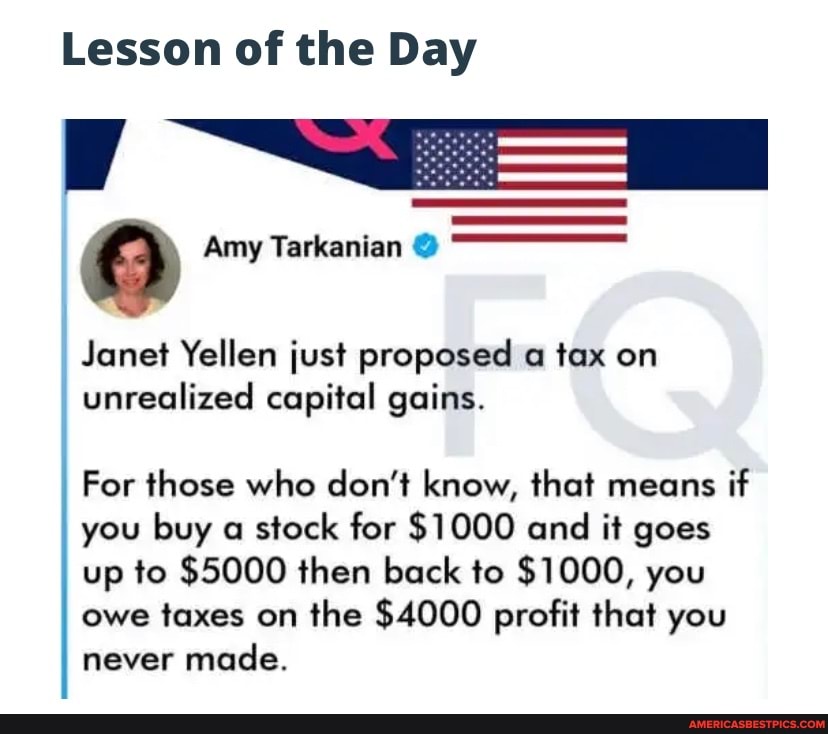

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

Capital Gains Tax Breaks Are Finally On The Defensive Itep

The Trouble With Unrealized Capital Gains Taxes The Spectator World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)